Create a Line Item Invoice

For an API request to create a Line Item Invoice, the following parameters are either always required or can be required if the subscriber specifies so.

| Parameter | Required | Note |

|---|---|---|

| InvoiceNumber | Required | |

| WoIdentifier | Required | |

| InvoiceText | Optional/Required | Required when Require Resolution Text is enabled in the invoice settings. |

| Labors | Optional/Required | Required when For Labor Charges subsection of the invoice settings includes the WO trade and/or category. |

| Materials | Optional/Required | Required when For Materials Charges subsection of the invoice settings includes the WO trade and/or category. |

| InvoiceTaxesDetails | Optional/Required | Required for all countries, except USA and Canada. |

See Invoice Parameters for a detailed description of each parameter and Gather Invoice Requirements for information on invoice settings.

Important: The default value of monetary amounts is 0 (zero).

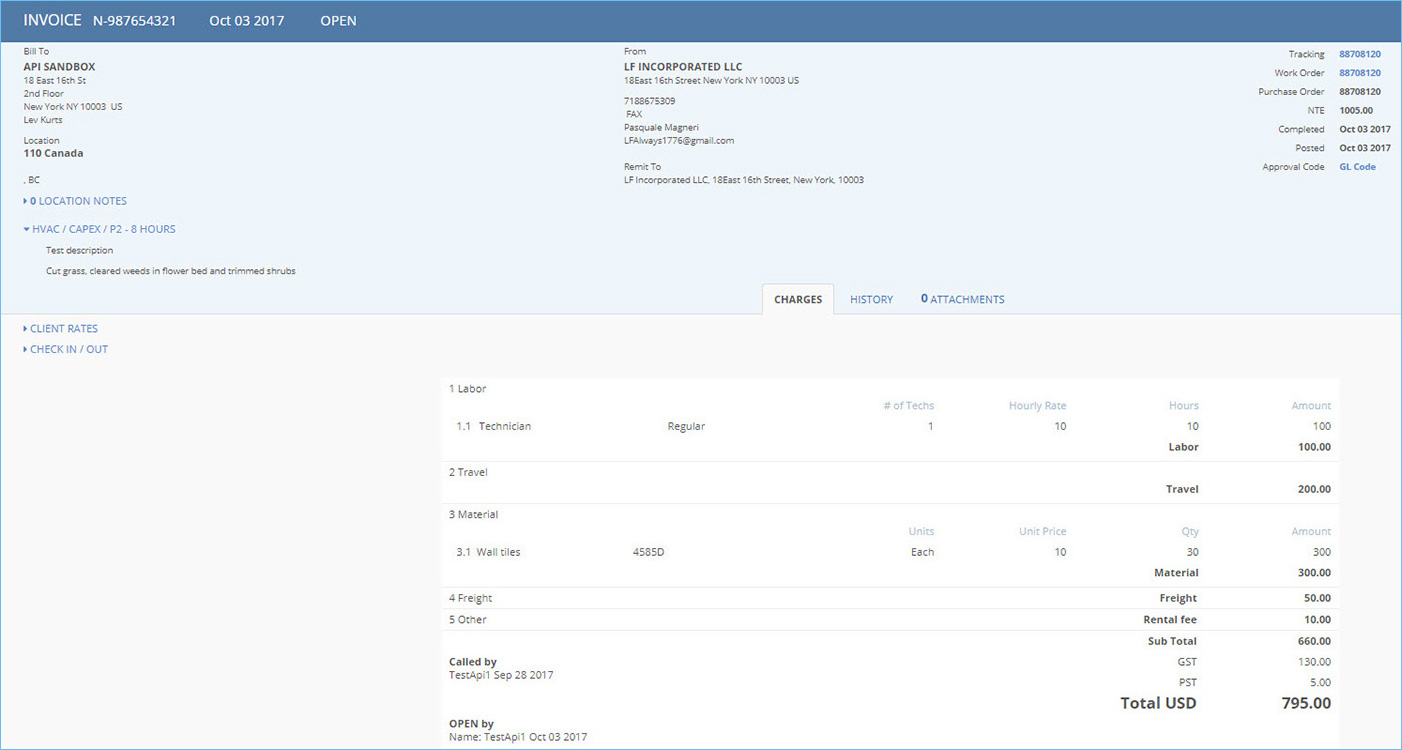

USA or Canada

For USA and Canada, send the following API request to create a Line Item Invoice:

POST /invoices

| Header | Value |

|---|---|

| Content-Type | application/json |

| Parameter | Parameter type | Example value |

|---|---|---|

| request | Body | See below |

POST https://sb2api.servicechannel.com/v3/invoices HTTP/1.1

Authorization: Bearer {access_token}

Content-Type: application/json

{

"InvoiceNumber": "N-987654321",

"WoIdentifier": "88708120",

"InvoiceTax": 130,

"InvoiceTotal": 795,

"InvoiceText": "Cut grass, cleared weeds in flower bed and trimmed shrubs",

"InvoiceAmountsDetails": {

"LaborAmount": 100,

"MaterialAmount": 300,

"TravelAmount": 200,

"FreightAmount": 50,

"OtherAmount": 10,

"OtherDescription": "Rental fee"

},

"Tax2Details": {

"Tax2Amount": 5,

"Tax2Name": "PST"

},

"Labors": [

{

"SkillLevel": "2",

"LaborType": "1",

"NumOfTech": "1",

"HourlyRate": 10,

"Hours": 10,

"Amount": 100

}

],

"Materials": [

{

"Description": "Wall tiles",

"PartNum": "4585D",

"UnitType": "1",

"UnitPrice": 10,

"Quantity": 30,

"Amount": 300

}

]

}

Example response:

{

"Id": 42224724

}

Response code: HTTP/1.1 201 Created

Note: Add Tax2Details only for Canada.

This is how the created invoice is displayed in the UI:

Other Countries

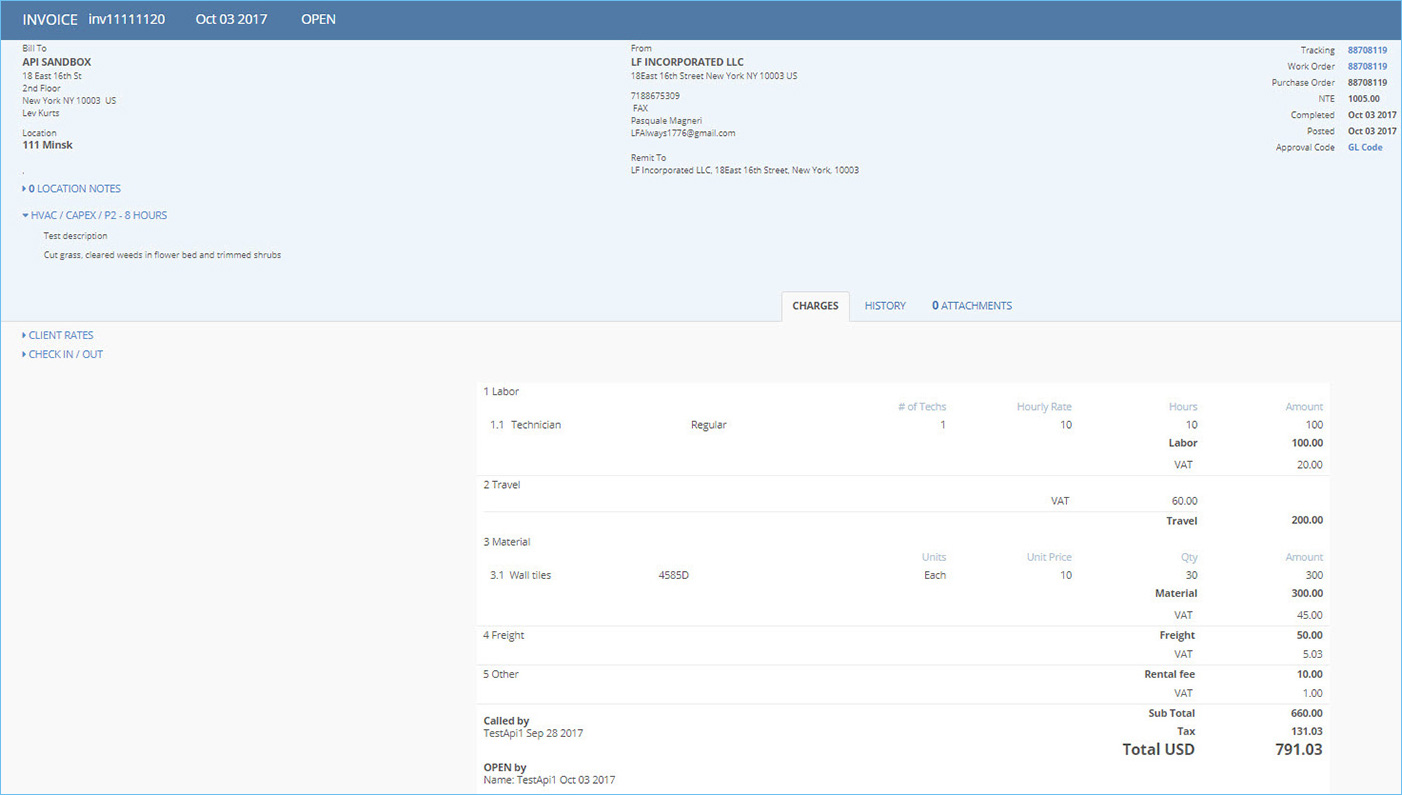

When a subscriber’s location is not in the USA or Canada, generate an International Line Item Invoice:

POST /invoices

| Header | Value |

|---|---|

| Content-Type | application/json |

| Parameter | Parameter type | Example value |

|---|---|---|

| request | Body | See below |

POST https://sb2api.servicechannel.com/v3/invoices HTTP/1.1

Authorization: Bearer {access_token}

Content-Type: application/json

{

"InvoiceNumber": "inv11111120",

"WoIdentifier": "88708119",

"InvoiceTax": 131.025,

"InvoiceTotal": 791.025,

"InvoiceText": "Cut grass, cleared weeds in flower bed and trimmed shrubs",

"InvoiceAmountsDetails": {

"LaborAmount": 100,

"MaterialAmount": 300,

"TravelAmount": 200,

"FreightAmount": 50,

"OtherAmount": 10,

"OtherDescription": "Rental fee"

},

"InvoiceTaxesDetails": {

"LaborTax": 20,

"MaterialTax": 45,

"TravelTax": 60,

"FreightTax": 5.025,

"OtherTax": 1

},

"Labors": [

{

"SkillLevel": "2",

"LaborType": "1",

"NumOfTech": "1",

"HourlyRate": 10,

"Hours": 10,

"Amount": 100

}

],

"Materials": [

{

"Description": "Wall tiles",

"PartNum": "4585D",

"UnitType": "1",

"UnitPrice": 10,

"Quantity": 30,

"Amount": 300

}

]

}

Example response:

{

"Id": 42224723

}

Response code: HTTP/1.1 201 Created

When you open the created invoice in the UI, you see the following information: